📊 U.S. regulators axe prediction markets

Plus: Kalshi accuses data provider of extortion before taking it back, Paradigm launches new prediction market product, and more.

GM. You’re reading PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes.

Here’s what we got for you today:

🎫 US Regulators revise Biden-era prediction markets policies

😬 Kalshi's "extortion" claim against small data firm lasts less than a day

💻 Paradigm launches prediction market data explorer

📈 Market Moves

📊 Odds & Ends

REGULATORS REVISE PREDICTION MARKET POLICIES 🎫

The CFTC woke up on Tuesday and decided to erase a year of vibes.

Under new leadership, the agency announced it was throwing out the Biden-era approach to prediction markets and starting over from scratch, a move that landed with the quiet violence of a reset button pressed mid game. The guidance that had allowed platforms like Kalshi to edge into political and economic forecasting through a series of grudging approvals was framed as a regulatory experiment that wandered too far, too fast, and without sufficient adult supervision.

The statement read like an institutional throat clearing exercise, full of procedural language about process, consistency, and statutory mandate, yet the subtext came through clearly. Prediction markets had been allowed to grow in a gray zone where innovation filled the gaps left by unclear rules, and the new commission chair wanted that gray zone scrubbed clean even if it meant sending everyone back to the lobby.

For Kalshi, the timing could not have been worse. The company had spent months positioning itself as the compliant alternative to crypto native platforms, the good student who did the homework and raised a hand before speaking. Its pitch rested on the idea that federal regulators could be partners rather than adversaries, an idea that looked persuasive right up until the regulator announced a wholesale do over.

What had previously been framed as cautious experimentation was reframed as regulatory drift, a period where enthusiasm outran clarity and where staff level decisions carried more weight than they should have. By promising a reset, the commission signaled that prior approvals offered little comfort, and that every market category from elections to macroeconomic indicators could find itself back on the chopping block.

This mattered beyond a single company or product line. Prediction markets had begun to attract serious capital and mainstream attention precisely because they appeared to be stabilizing into a recognized financial category rather than a novelty adjacent to gambling. A public declaration that the rules themselves were up for reconsideration injected uncertainty at the exact moment the industry was trying to sell inevitability.

The irony was that the commission framed the move as a return to rigor. By discarding informal guidance and ad hoc approvals, leadership argued it was protecting market integrity and public trust. Yet from the outside, the message felt less like discipline and more like volatility, a reminder that regulatory goodwill could evaporate overnight and that yesterday’s green light could become today’s footnote.

Prediction markets thrive on probabilities, on the idea that distributed information can converge toward truth. The regulator’s reset introduced a different kind of probability, one that founders and investors would now have to price in, a chance that compliance itself remained a moving target. The market could forecast elections, inflation prints, and rate cuts with impressive precision, yet forecasting the regulator suddenly looked like the hardest contract on the board.

The do-over reminded everyone involved that legitimacy remains provisional, that institutional acceptance arrived in phases rather than triumphs, and that the line between experiment and establishment stayed thinner than the marketing copy suggested.

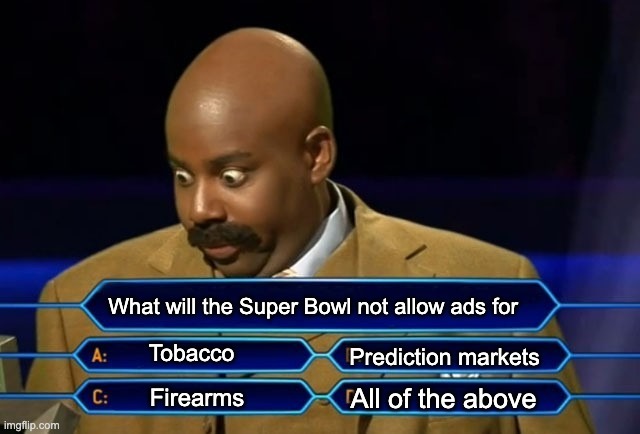

ANOTHER KALSHI PR CRISIS 😬

Kalshi's communications team had a rough 24 hours. A Citizens bank analyst named Jordan Bender published a report using data from a small startup called Juice Reel, arguing that prediction market users lose money faster than players on traditional gambling apps. The numbers were ugly: the bottom 25% of prediction market bettors lost roughly 28 cents per dollar wagered in their first three months, compared to 11 cents per dollar on conventional gambling platforms. For the bottom decile, losses climbed to 44%.

Kalshi's response was to tell Bloomberg the analysis wasn't just wrong, but part of an "extortion" plot by Juice Reel. According to TipRanks, Kalshi claimed the startup's CEO had offered to "defuse the situation" in exchange for an investment meeting with Kalshi's leadership. Ricky Gold, Juice Reel's founder, called the allegation a "complete fabrication" and countered that Kalshi had pressured him to say the data was inaccurate.

Hours later, Kalshi backed down. "After further review, we don't believe the intention was extortion," a spokesperson said. The company continued to dispute the findings but denied pressuring Juice Reel to repudiate its methodology.

The walkback is almost more damaging than the original accusation. Calling a research report "extortion" is a serious claim, one that a company generally only makes if it has the receipts. Walking it back the same day suggests either poor internal communication or a panic response that leadership had to clean up. Neither is a great look for a company trying to position itself as a mature financial services player rather than a scrappy startup.

Prediction markets have marketed themselves as more "level" than sportsbooks, matching bettors against each other rather than taking the house's side. Data showing users lose money faster than on traditional gambling apps cuts directly against that positioning, especially when the average prediction market bet runs about $185 compared to $55 at regulated internet sportsbooks.

Kalshi still disputes the methodology, and without seeing the full Citizens report, it's hard to evaluate whether the data is solid. But the company's handling of the dispute did more to draw attention to the findings than the original report ever would have.

THE $10B CRYPTO FUND BUILT A PREDICTION MARKET DASHBOARD 💻

Paradigm, the crypto VC firm behind investments in Coinbase, Uniswap, and FTX, just released a new tool for exploring prediction market data. It's live at predictions.paradigm.xyz, and it's one of the best visualization of the prediction market landscape I've seen.

The tool uses treemaps to organize 30 million market questions into a zoomable hierarchy. You can drill down from broad categories into subcategories, compare Kalshi to Polymarket side by side, toggle between volume and open interest, and scrub through time to see how markets evolved over days, months, or years. It makes it easy to see which topics are actually getting action and how that's changed over time.

The data work behind it is more interesting than it sounds. According to Storm Slivkoff, who built it, organizing 30 million market questions into an intuitive hierarchy was the hard part, and LLMs were "less helpful than you'd think" for labeling abstract data at scale. The result is a clean taxonomy that actually makes sense to click through.

Paradigm is an investor in Kalshi, which they disclose. But the tool covers both Kalshi and Polymarket, and it's genuinely useful for anyone trying to understand what's happening in these markets. With the World Cup, Winter Olympics, and elections in Germany, Brazil, and the US all hitting this year, having better tools for seeing where volume is flowing matters.

MARKET MOVES 📈

📈 Biggest swing: “Another critical Cloudflare incident by February 28?” moved 17% → 100% (Polymarket)

💰 Top earner: @weflyhigh - $250,119 24H Profit (Polymarket)

🤔 Weirdest market: “Will Trump nationalize elections?” (Polymarket)

ODDS & ENDS 📊

Epstein alive? Traders speculating new conspiracy.

MGM stocks surged due to strong sports betting results, but how long can traditional sportsbooks fend off prediction markets?

Jupiter Exchange brings Polymarket trading to Solana for the first time.

RATE TODAY’S EDITION

What'd you think of today's edition? |