📊 The $7.8B protocol adding prediction markets

Plus: CBOE tries vintage options trading tactics, Kalshi goes hard in the paint with marketing, Coinbase and Kalshi team up, and more.

GM. You’re reading PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes.

Here’s what we got for you today:

🚀 The #1 protocol in crypto wants prediction markets too

📼 CBOE eyes binary options comeback to take on prediction markets

🛒 Kalshi experiments with aggressive marketing

📈 Market Moves

📊 Odds & Ends

11 PEOPLE, $2.95 TRILLION IN VOLUME, AND NOW PREDICTION MARKETS 🚀

Hyperliquid is getting into prediction markets. The crypto perpetual exchange is currently the #1 protocol by 24-hour revenue across all of crypto, averaging $2.7M daily with a team of 11 people. Now it's announced HIP-4: outcome trading, a new primitive enabling fully collateralized contracts that settle within fixed ranges and open the door to prediction markets being built on the platform.

For context: Hyperliquid does $2.95 trillion in annualized trading volume with a $7.8 billion market cap and ~$800 million in net income. That's comparable to Robinhood's volume, except Robinhood has 2,300 employees and trades at 44x earnings. Hyperliquid does it with 11.

The design breaks from Hyperliquid's perpetual futures core. No leverage, no liquidations. Instead you get dated contracts, full collateralization, and non-linear payoffs. It's on testnet now, with canonical markets coming in USDH. Permissionless deployment is the eventual goal.

This is a threat to everyone. Polymarket has liquidity and brand. Kalshi has regulatory cover. But Hyperliquid has $2.95 trillion in volume, composability with derivatives infrastructure, and a team of 11 that just decided prediction markets are worth building. The smaller protocols get squeezed first. The bigger ones should be paying attention.

CBOE DUSTS OFF THE 2008 PLAYBOOK 📼

Cboe Global Markets is in early-stage talks with retail brokerages and market makers to relaunch binary options for individual investors. The contracts work exactly like prediction market bets: a fixed cash payout if a condition is met, zero if it isn't. "Think of us entering the event space, using those products to offer a more simplistic event-style contract like you're seeing on other platforms," said Rob Hocking, Cboe's global head of derivatives.

Back in July 2008, Cboe launched binary options on the S&P 500 and VIX - contracts that paid $100 or nothing, with prices quoted like probabilities. They never gained traction. But Kalshi and Polymarket have since proven massive retail demand for yes-or-no wagers, and the CME-FanDuel partnership launched in five states in December. The establishment is paying attention.

Binary options carry serious baggage. The SEC and CFTC have issued joint warnings about fraud on unregulated platforms, including manipulation of trading software and refusal to process withdrawals. By routing these contracts through licensed brokers, OCC clearing, and exchange surveillance, Cboe can offer the prediction market experience without the Wild West counterparty risk. JJ Kinahan, a market structure exec quoted in the WSJ, noted the product would go through "a lot of rigor" on legal and compliance.

If Cboe can embed binary options into Robinhood, Schwab, and Fidelity accounts - where 61 million options already trade daily - they'll have distribution Kalshi can only dream about. No new account signup, no crypto wallet, no learning curve. Just another ticker in your existing brokerage app. The real target isn't Polymarket's election contracts or Golden Globes bets. It's Kalshi's fast-growing index and macro business.

The tradeoff is scope. Prediction markets' appeal isn't just the payoff structure - it's betting on Fed meetings, earnings calls, whether your candidate wins. Cboe is staying narrower: S&P closes above 7000, VIX spikes past 30. Whether retail traders actually want the stripped-down version remains to be seen. The 2008 launch suggests they didn't, but Kalshi's volume suggests the demand now exists. Cboe is betting that same demand will flow to whoever offers the cleanest on-ramp - and no one has better broker relationships.

KALSHI TRIES NEW MARKETING TACTICS 🛒

Kalshi just turned a prediction market into a sidewalk level acquisition funnel in the East Village, using free groceries as the hook and regulated event contracts as the engine. People download the app, place a trade, and walk away with dinner, which converts abstract future resolution into immediate physical value and collapses the distance between a niche financial product and everyday life.

For readers who already understand prediction markets, this is a distribution play rather than a gimmick. Kalshi already has regulatory clearance, settlement infrastructure, and a catalog of contracts that look familiar to anyone who has traded elections or macro events. What it lacked was density of casual users, and groceries solve that problem with brutal efficiency because food is universally legible and instantly useful.

The marketing tactic matters more than the giveaway itself. Free groceries function as a real world sign up bonus that bypasses ad auctions, influencer funnels, and referral loops. The cost per user is visible and capped, the conversion step forces a first trade, and the resulting order flow produces liquidity, behavioral data, and habit formation. This is customer acquisition designed around the actual mechanics of prediction markets rather than generic fintech growth theory.

There is also a signaling layer aimed squarely at competitors. Crypto native markets have trained users to chase points and airdrops that promise future upside. Sportsbooks rely on risk free bets that still feel like gambling promotions. Kalshi is anchoring value in the present while keeping the core action firmly in event trading, which reframes the category as something closer to a utility than a speculative toy.

If this approach scales, the implications get uncomfortable for everyone else. A regulated market that can activate users offline gains a channel that most digital platforms never touch. Physical presence creates trust, familiarity, and repetition, and it turns compliance from a cost center into a growth advantage. The groceries are the headline, but the real product being sold is a habit, and habits built this way tend to stick.

MARKET MOVES 📈

📈 Biggest swing: “Will Trump admin release any more Epstein related files by February 6?” moved 48% → 96% (Polymarket)

💰 Top earner: @0x492442EaB586F242B53bDa933fD5dE859c8A3782 - $255,601 24H Profit (Polymarket)

🤔 Weirdest market: “Will Trump launch a coin by December 31?” (Polymarket)

ODDS & ENDS 📊

A Cloudflare employee created a LLM-powered trading agent that adapts to social sentiment and makes trading decisions using AI.

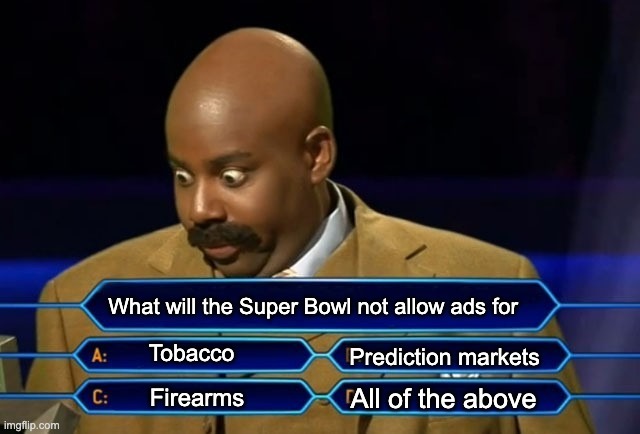

New York Attorney General warns NY citizens about the dangers of prediction markets days before the super bowl

RATE TODAY’S EDITION

What'd you think of today's edition? |