📊 Jump buys Kalshi and Polymarket

Plus: Kalshi's NCAA Problem, record super bowl volume, Polymarket sues Massachusetts, and new fintech acquisitions.

GM. You’re reading PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes. Also, if you’re interested in jobs in the space, check out openings at Novig here. They’re absolutely ripping, and the team is ready to take off.

Here’s what we got for you today:

🚀 Jump Trading joins in as market-maker

⚖️ Polymarket files federal lawsuit to block Massachusetts from enforcing state gambling laws

🏈 Kalshi's NCAA problem is getting worse

📈 Market Moves

📊 Odds & Ends

JUMP TRADING TAKES STAKES IN BOTH KALSHI AND POLYMARKET 🚀

Jump Trading is taking equity in Kalshi and Polymarket in exchange for doing what it already does best, which is standing in the middle of markets and making sure trades clear when other participants hesitate. The firm agreed to provide liquidity on both platforms, with ownership structured as part of the deal, according to people familiar with the arrangements.

The mechanics differ in ways that reveal how each platform sees itself. Kalshi granted Jump a fixed equity stake, reflecting its emphasis on regulatory clarity and a more traditional exchange model. Polymarket chose a performance based structure, allowing Jump’s ownership to grow as it supplies more trading capacity, effectively tying long term control to day to day participation. In both cases, Jump gets rewarded for tightening spreads and keeping markets active when demand thins.

For Jump, the appeal is obvious. The firm now owns pieces of the two most prominent prediction markets at a moment when private valuations have ballooned, with Polymarket valued around nine billion dollars and Kalshi closer to eleven. Liquidity provision already generates consistent trading revenue, and the equity component turns that operational role into a longer term bet on market structure rather than individual outcomes.

Kalshi and Polymarket gain something equally important. Institutional market makers absorb volatility, step in when retail traders pull back, and prevent prices from freezing during moments of uncertainty. Traditional exchanges solved this problem decades ago with rebates and formal incentives. Prediction markets are arriving at the same solution through bespoke deals and venture style economics.

There is precedent. Susquehanna International Group publicly committed to making markets on Kalshi in 2024, and later partnered with Robinhood to acquire LedgerX, securing direct control over the infrastructure required to list and clear event contracts. Jump’s move fits neatly into that pattern, reinforcing the idea that prediction markets are being absorbed into the broader derivatives ecosystem rather than remaining a niche adjacent to gambling.

Inside Jump, the shift has been underway for months. The firm has added staff, committed capital, and built technology tailored to event based contracts regulated by the Commodity Futures Trading Commission. More than twenty traders now focus on prediction markets, using the same data driven models Jump applies across futures, treasuries, and crypto.

Taken together, these deals signal a transition that is easy to miss beneath headlines about elections and sports bets. Prediction markets increasingly rely on institutional liquidity, exchange style incentives, and ownership earned through participation. Jump formalized that reality by converting its role at the center of the order book into a direct economic claim on the platforms themselves.

At that point, the story stops looking speculative and starts looking infrastructural. When firms built on shaving fractions of a cent decide event contracts belong alongside futures and options, it suggests prediction markets have crossed into a more permanent phase. Jump appears content to collect returns from whichever direction that evolution takes.

POLYMARKET SUES MASSACHUSETTS ⚖️

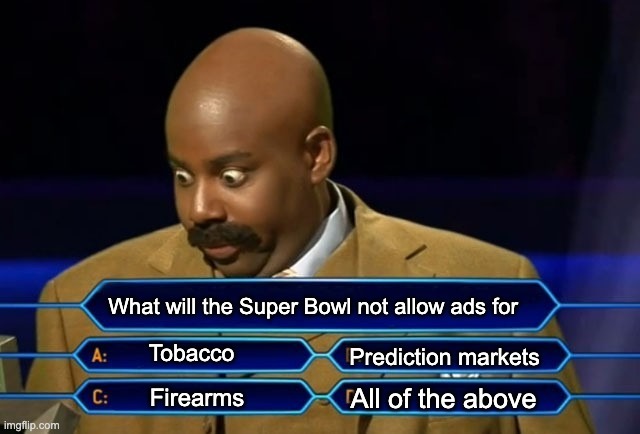

Polymarket filed a federal lawsuit Monday against Massachusetts AG Andrea Joy Campbell and top officials at the Massachusetts Gaming Commission, seeking a declaratory judgment that state gambling laws are preempted by the Commodity Exchange Act and an injunction blocking enforcement. The argument: Congress gave the CFTC exclusive jurisdiction over derivatives traded on designated contract markets, and event contracts fall within that perimeter. States don't get to override that by calling these products unlicensed sports wagering.

The filing came days after a Massachusetts state court judge issued a preliminary injunction against Kalshi, ordering the platform to stop offering sports event contracts to Bay State residents without a state license — the first time a court sided with a state regulator against a prediction market. Polymarket read it as a signal they were next, and went on offense rather than waiting for the AG to come to them. "Racing to state court to try to shut down Polymarket US and other prediction markets doesn't change federal law," CLO Neal Kumar said.

Inside the complaint, Polymarket leans hard on recent CFTC posture. It cites Chairman Michael Selig's January 29 remarks describing event contracts as within the agency's regulatory domain and criticizing state litigation for creating jurisdictional uncertainty. It also flags the CFTC seeking leave to file an amicus brief in a Nevada appeal involving Crypto.com and the North American Derivatives Exchange, a signal the agency intends to defend federal preemption in court, not just in speeches. Polymarket is betting the CFTC will have its back if this reaches trial.

A Nevada judge blocked Polymarket from offering sports contracts just a week before the Massachusetts filing, and at least eight other states — New York, Illinois, Ohio among them — have moved to restrict sports-related prediction markets. The pattern isn't hard to read: states with established sports betting regimes, and the tax revenue that comes with them, see prediction markets as unlicensed competitors cutting into DraftKings and FanDuel territory. Whether these products are derivatives or gambling is no longer an academic question. It's the fault line that determines whether prediction markets operate as a single national market or get carved up jurisdiction by jurisdiction.

If federal courts agree that the CEA preempts state gambling laws, it establishes the precedent the entire industry needs: one federal regulator, one rulebook, no more state-level whack-a-mole. If they lose, every state AG with a sports betting lobby gets a playbook. With Polymarket at a $9 billion valuation and Kalshi at $11 billion, neither can afford a future where half the country is geofenced. Polymarket is making the argument the industry has been building toward for years — they just need a federal judge in Massachusetts to agree.

WHEN PREDICTION MARKETS MEET THE NCAA 🏈

A University of Tennessee student worker on the sports broadcast team was fired after betting on a UT football game through Kalshi during the 2025 season. The worker, who filmed games for live production, placed wagers on NFL, NBA, and college football in October. ProhiBet, the monitoring service used by the SEC and major pro leagues, flagged the activity and notified UT in November.

Normally, sports gambling by athletic department staff is a serious NCAA offense, but the timing was messy. In October, the NCAA approved a policy letting staff bet on professional sports, effective Nov. 1. Three weeks later, they reversed course after gambling scandals at Arizona State, Temple, and others surfaced. The student worker placed his bets in the middle of that whiplash, which the NCAA acknowledged as a mitigating factor.

The other mitigating factor: he used Kalshi. Unlike DraftKings or BetMGM, Kalshi operates as a peer-to-peer prediction market where users buy Yes/No contracts on outcomes rather than betting against the house. That distinction has created genuine confusion inside college athletics about whether a Kalshi trade even counts as "sports gambling" under NCAA rules. It does. But the gray area worked in UT's favor as the infraction was classified Level III, the lowest tier, and the school got little more than a warning.

NCAA president Charlie Baker isn't letting that gray area stand. When Kalshi floated letting users bet on transfer portal decisions in December, Baker fired back publicly, calling it exploitative. Kalshi backed down. In January, Baker asked the CFTC to pause all college sports offerings on prediction markets until safeguards are in place. Kalshi has spent years arguing prediction markets are a financial product, not gambling. In college sports, that defense is about to hit its ceiling.

MARKET MOVES 📈

📈 Biggest swing: “Will Anthropic be the first company to have an AI model hit 1500 on Chatbot Arena by June 30 2026?” moved 24% → 100% (Polymarket)

💰 Top earner: @Chimera - $109,191 24H Profit (Kalshi)

🤔 Weirdest market: “Grok 4.20 released on…?” (Polymarket)

ODDS & ENDS 📊

Kalshi led Super Bowl moneyline notional volume with $500M, trailed by Opinion with $207M and Polymarket with $55M.

Chamath and Mr. Beast team up to buy a bank

Kalshi invoked rule 6.3(c) for “Cardi B to perform during the Super Bowl” market so that the strike would pay out $0.26 on the dollar at the last traded price.

RATE TODAY’S EDITION

What'd you think of today's edition? |

MEME OF THE DAY 😂