What is Polymarket?

The Platform That Called the 2024 Election

Polymarket is a prediction market. What does that even mean?

The concept is simple: if you think something is going to happen and other people disagree, you can bet on it. If you're right, you profit. If you're wrong, you lose what you bet.

For example, the Browns are playing the Seahawks this weekend, and the market thinks Cleveland has a 99% chance of winning. You disagree, and you think Seattle's going to pull off the upset. On Polymarket, you could buy "Seahawks win" at 1 cent per share. If they actually win, each share pays out $1. That's a 100x return. Of course, if the Browns win, your shares are worth nothing (but what’re the odds of that?)

However, Polymarket doesn't set odds, the traders do. Every bet has someone on the other side, and prices move based on supply and demand. There's no house edge, no vig. If you think the crowd is wrong, you can bet against them directly.

You can bet on almost anything. Elections, Fed rate decisions, crypto prices, sports, whether a celebrity couple stays together. If people care about the outcome, the market gets created. (Note: If you’d like more predictions market knowledge, check out our predictions markets guide)

The basics

Polymarket lets you bet on real-world events using crypto (elections, sports, culture, you name it)

Odds are set by traders, not the house

You need a crypto wallet and USDC to get started

Now available to US users after receiving CFTC approval in November 2025

The details

When you buy "Yes" on an outcome, someone else is selling you that position. When you buy "No," same deal. Every trade has two sides, and the price moves based on supply and demand, just like a stock. No house taking a cut. The market is just other people. If you think the crowd is wrong, you can bet against them and profit when reality proves you right.

Under the hood, this all runs on a Central Limit Order Book (CLOB). The order book matches buyers and sellers at specific prices.

Every contract is worth $1 if it resolves to "Yes" and $0 if it resolves to "No." So if you buy "Yes" at 49 cents, you're betting you'll get $1 back which means a profit of 51 cents. The person selling you that position is effectively betting on "No" at 51 cents.

Real example below:

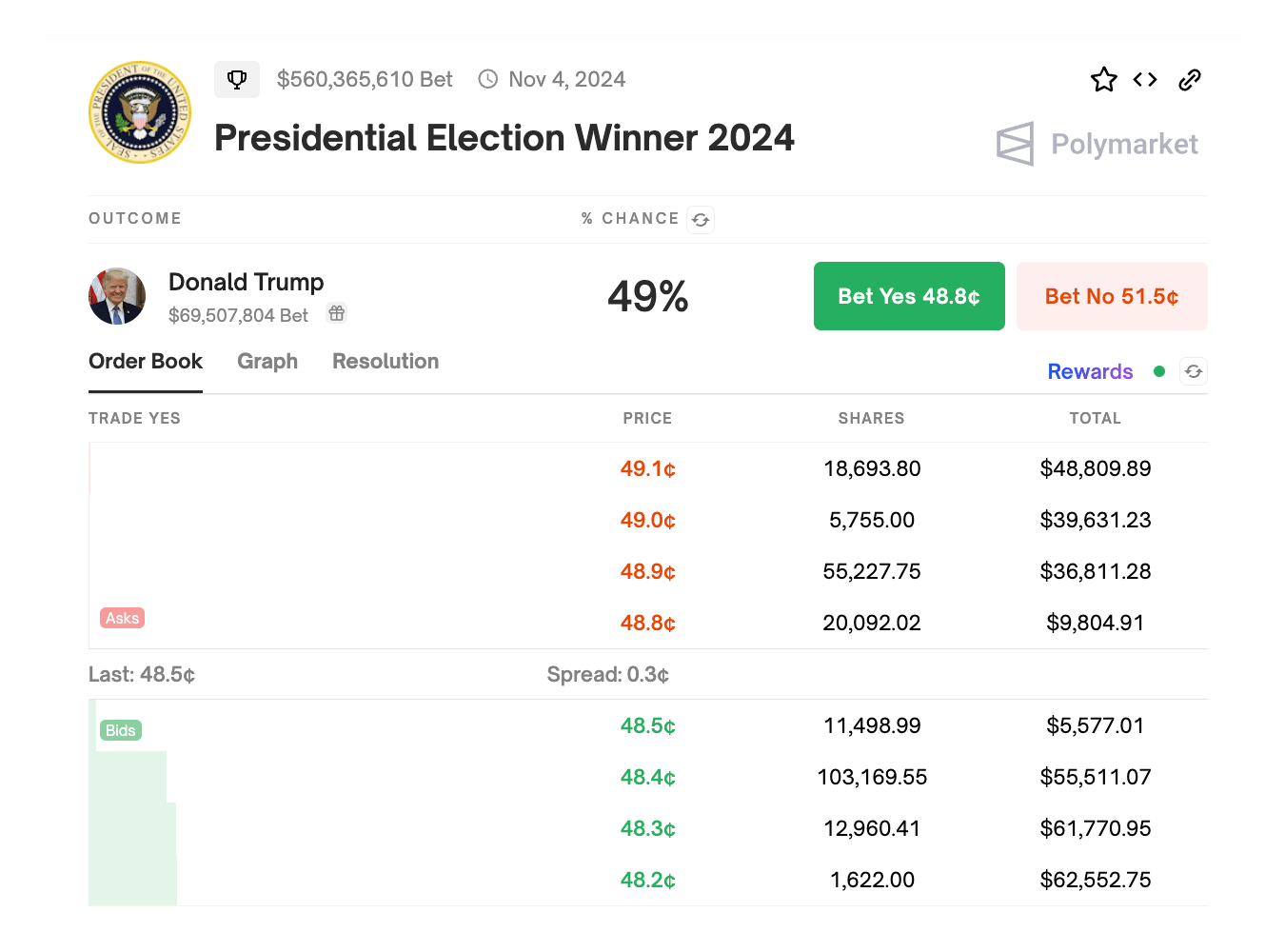

Source: Polymarket

This is the 2024 presidential election market, specifically Trump’s odds to win. The displayed chance is 49%, but you'll notice the actual prices differ slightly. If you want to buy "Yes," you'd pay 48.8 cents (the best ask). If you want to buy "No," you'd pay 51.5 cents (which is $1 minus the best bid of 48.5 cents). That gap is the bid-ask spread, aka the difference between what buyers are offering and what sellers are asking.

The depth of the book matters too. In this example, 11,000 shares are available at 48.5 cents, and another 100,000 at 48.4 cents. More liquid markets have tighter spreads and more depth, meaning you can get in and out of larger positions without moving the price.

Different markets

Polymarket structures everything in yes-no formats:

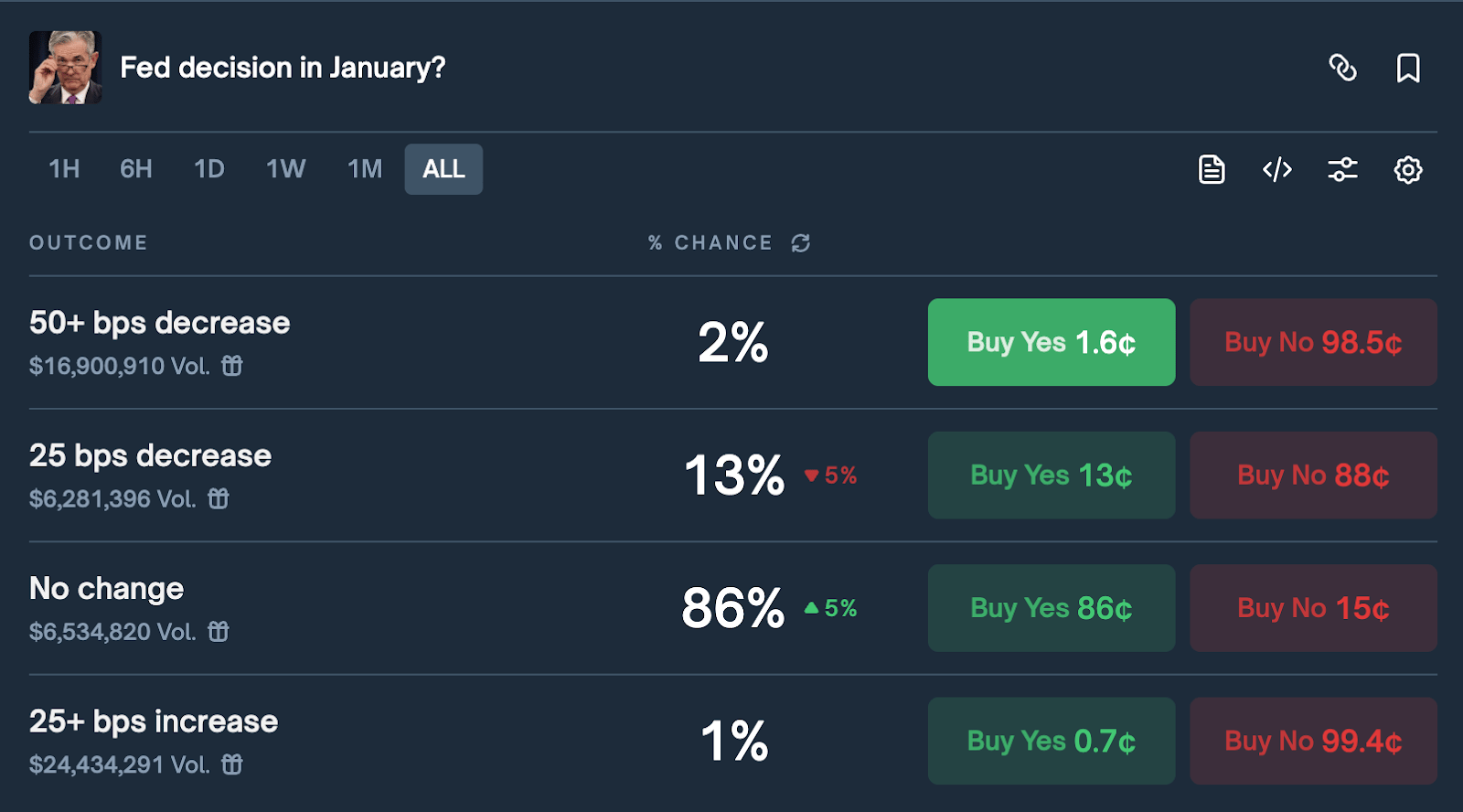

Source: Polymarket

Range markets break continuous outcomes into discrete buckets. Ex: Fed rate decision: instead of one market, you get separate yes/no markets for each possible outcome - "25bps cut," "50bps cut," "no change," and so on. You can back the bucket you think is most likely or bet against one you think the market is overpricing.

Source: Polymarket

Categorical markets work similarly for questions with multiple possible winners. The 2028 Republican nominee market, for example, has a separate yes/no contract for each candidate. Each one has its own order book, and you can trade any of them independently.

Most events on Polymarket are also categorized into one of the following categories, so you can easily dive into your area of expertise or interest.

Politics: Elections, legislation, appointments

Crypto: Bitcoin prices, ETF approvals, protocol upgrades

Sports: Game outcomes, championships, player moves

Culture: Celebrity drama, award shows, viral moments

Economics: Fed rates, inflation, jobs reports

How markets resolve (the Oracle 🔮)

With thousands of markets running at any given time, Polymarket can't manually verify every outcome. Instead, it uses UMA's Optimistic Oracle: a decentralized system for determining what actually happened.

Here's the process:

Proposal: Event concludes, anyone can propose the outcome ("Trump won" or "Bitcoin hit $100k"). The proposer puts up a bond as collateral.

Challenge period. For a set window (typically a few hours), anyone can dispute the proposed outcome by posting their own bond. If nobody disputes, the proposal is accepted and the market resolves.

Dispute resolution. If someone does challenge, UMA token holders vote on the correct outcome. The losing side forfeits their bond, which creates a strong incentive to only propose or dispute when you're confident you're right.

Payout. Once resolved, winning shares are redeemable for $1 each. Losing shares go to $0.

In practice, most markets resolve without disputes because outcomes are obvious aka game ends, election called, price hit the target. The challenge mechanism exists as a safeguard.

Edge cases

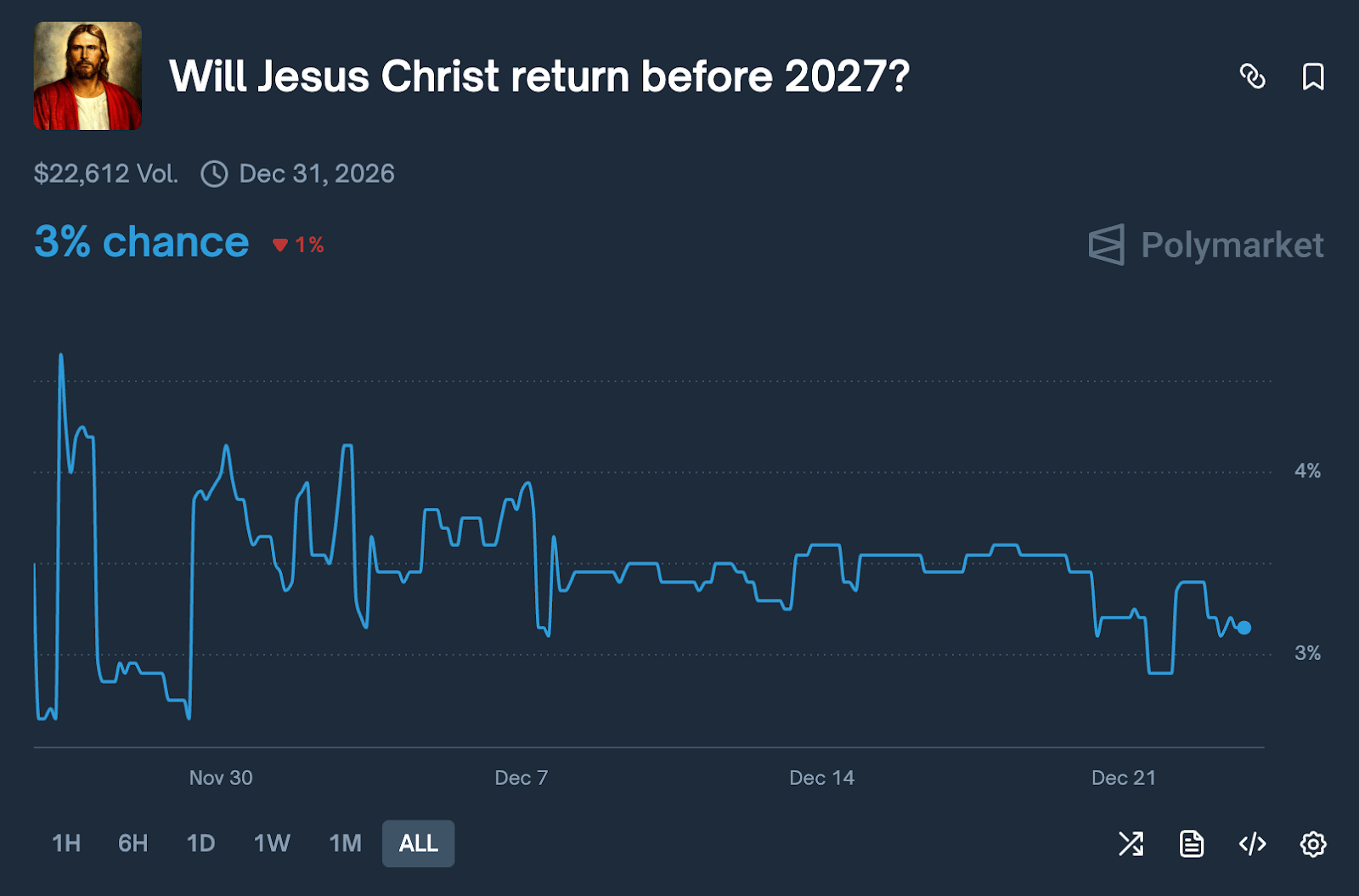

Source: Polymarket

Polymarket hosts some pretty speculative stuff, like "Will Jesus Christ return before 2027?" Same process. If the deadline passes and the event hasn't happened, someone proposes "No," the challenge window passes, and the market resolves. The system doesn't require a central authority to decide, it just needs one person to state the obvious and no one to credibly disagree.

Ambiguous outcomes do happen. Maybe the resolution criteria were poorly worded, or an event technically happened but not in the way people expected. In these cases, disputes go to a UMA vote, which can delay resolution by several days. It's rare, but worth knowing that edge cases exist.

Frequently Asked Questions

Is Polymarket legal?

Yes! As of November 2025, Polymarket is fully legal for US users after acquiring QCEX (a CFTC-licensed exchange) and receiving regulatory approval. Previously, US residents were blocked following a 2022 CFTC fine, but those days are over.

How do I withdraw my winnings?

When a market resolves in your favor, your winning shares become worth $1 each. You can redeem them for USDC, then withdraw to your wallet. From there, you can send to an exchange and cash out to your bank.

What are the fees?

Polymarket doesn't charge trading fees. You'll pay small gas fees for transactions on Polygon (usually pennies), and there's a small spread between buy and sell prices set by the market.

Can I lose more than I bet?

No. Unlike leverage trading, you can only lose what you put in. If you buy $50 of "Yes" shares and the outcome is "No," you lose $50. That's it.

What happens if a market is ambiguous?

UMA's oracle handles disputes. If the outcome isn't clear, token holders vote. This is rare, but it happens and it can delay resolution.

Is Polymarket the only prediction market?

No, but it's the biggest. Alternatives include Kalshi (US-regulated, limited markets), Augur (fully decentralized), and PredictIt (academic, limited). Polymarket has the most liquidity and variety.

Is there a mobile app?

Yes! The iOS app is live on the App Store. Android is coming soon. You can also use the mobile web version, which works well.

To sum it all up

Polymarket is the biggest prediction market in crypto and arguably the most accurate forecasting tool we have. During the 2024 election, Polymarket had Trump at 60%+ while FiveThirtyEight and most pollsters called it a toss-up. $3.6 billion was wagered on that single question. The market was right.

Whether you want to bet on the next election, hedge your portfolio, or just watch the odds to understand what the crowd really thinks, Polymarket is worth knowing about.

So here's the real question: What do you know that the market doesn't?