📊 Coinbase and Kalshi go nationwide

Plus: the Coalition for Prediction Markets speaks up, Gen Z takes advantage of new trading opportunities, and Polymarket breaks more records.

GM. You’re reading PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes.

Here’s what we got for you today:

🚀 Coinbase's "Everything Exchange" adds prediction markets

🗞️ Coalition for Prediction Markets Launches Seven-Figure PR Blitz After Maduro Trade Scandal

💰 Gen Z bets big on prediction markets

📈 Market Moves

📊 Odds & Ends

COINBASE BRINGS PREDICTION MARKETS TO ALL 50 STATES 🚀

Coinbase announced it's expanding prediction markets to all 50 U.S. states. At first glance, this looks like direct competition for Kalshi. It's not. Coinbase built the entire feature through a partnership with Kalshi, the CFTC-regulated platform that provides all the event contracts and initial liquidity. Rather than building from scratch, Coinbase is essentially white-labeling Kalshi's infrastructure and embedding it alongside crypto, stocks, and cash balances in a single app.

The setup lowers the barrier significantly. Minimum trades start at $1, and users can take Yes-No positions on elections, sports, economic indicators, and cultural events. Kalshi handles the regulatory compliance. Coinbase gets to offer a new product category without navigating CFTC registration itself. For Kalshi, it's distribution at scale with access to Coinbase's massive U.S. user base without the customer acquisition costs.

The move fits Coinbase's broader ambition to become an "everything exchange." They've already pushed into stocks, stablecoins, and derivatives, and recently acquired The Clearing Company to beef up their market infrastructure. Prediction markets slot neatly into that vision. The company isn't trying to out-innovate the prediction market specialists; it's trying to keep users inside one regulated platform.

Competition in this space is getting crowded. Robinhood and Webull have added prediction markets. CME Group partnered with FanDuel. Goldman Sachs is reportedly evaluating opportunities. The common thread: these are well-capitalized, heavily regulated incumbents. For crypto-native platforms like Polymarket that operate in regulatory gray zones, this wave of institutional entrants changes the game. The distribution war just got a lot more expensive.

Kalshi, meanwhile, comes out ahead no matter how Coinbase performs. If this integration works, Kalshi quietly becomes the backend for prediction markets across multiple consumer apps. That's a very different business than competing for direct users.

INSIDER TRADING? COULDN’T BE US 🗞️

On Wednesday, the Coalition for Prediction Markets ran a full-page ad in the Washington Post calling on Congress to codify insider trading protections for CFTC-regulated prediction markets. A spokesperson told Business Insider the ad is the "opening salvo" in a seven-figure PR campaign that will unfold over the coming months, timed to the coalition's government relations push for federal regulatory clarity.

Polymarket is conspicuously absent from the coalition's membership. The group includes Kalshi, Coinbase, Robinhood, Crypto.com, and Underdog - the major US-facing players who've built their brands on CFTC oversight. Polymarket, which was banned from serving US users from 2022 to 2025 after a $1.4 million CFTC penalty and only recently re-entered through its acquisition of a licensed exchange, hasn't made any public statements about the Maduro controversy. CEO Shayne Coplan has previously suggested insider trading can help disseminate information more broadly - a position that's increasingly difficult to defend when your platform is the one in the headlines.

Beyond the ads, the coalition is staffing up with serious Washington muscle. Former Congressman Sean Patrick Maloney (D-NY) joined as CEO and President earlier this month, with former House Financial Services Chair Patrick McHenry (R-NC) as Senior Advisor. That's the kind of bipartisan firepower you hire when you're preparing for a sustained federal fight against 30+ states that want to regulate prediction markets as gambling.

Legislative cover is coming from Rep. Ritchie Torres (D-NY), whose "Public Integrity in Financial Prediction Markets Act" would ban federal employees and elected officials from trading event contracts tied to government action. The coalition endorsed it immediately. It's a neat political play: support a bill that addresses the scandal's most sympathetic concern - government insiders profiting from classified intelligence - while reinforcing the broader message that federal regulation works.

The bet here is straightforward: absorb the reputational hit from Polymarket's scandal, use it to cement "regulated vs. offshore" as the defining industry frame, and lock in CFTC authority before state gaming commissions can carve out jurisdiction. Whether it works depends on whether Congress buys the distinction - and whether the next suspicious trade happens on a platform that paid for the ad.

GEN Z LOVES NEW MARKET OPPORTUNITIES 💰

A recent survey shows 31% of young Americans see prediction markets becoming a major cultural force, and they’re backing that belief with their time and money. What once felt fringe is starting to look like a cultural anchor for a generation raised on feeds, algorithms, and real-time discourse, reshaping how they engage with uncertainty and collective judgment.

What is emerging through this generational enthusiasm is a reinterpretation of markets as expressive tools rather than mere venues for gambling or speculation. Where traditional sports betting has long been framed as passive consumption of odds engineered by central operators, prediction markets exist as open canvases on which users inscribe their beliefs about outcomes ranging from elections to cultural phenomena. The willingness of younger participants to engage with these markets speaks to a deeper instinct toward agency and immediacy in information discovery, an instinct formed in social contexts where real-time consensus and collective judgment are constantly in play.

This generational orientation shapes not only where capital flows but how it is perceived. For many younger users, prediction markets feel closer to an interactive forum where belief becomes priced feedback and where conviction can be measured against a collective scoreboard. The data suggests that awareness of platforms like Polymarket is significantly higher among Gen Z and Millennials than among older cohorts, and that these users are increasingly willing to put real money behind their views. That dynamic transforms participation from passive trend following into active engagement with uncertainty itself.

The implications of this shift extend beyond the immediate experience of placing trades. As these markets mature alongside major cultural moments and events, they begin to act as real-time barometers of collective belief in ways that traditional media and slow moving institutions cannot match. Younger participants who grew up in ecosystems where flows of information shape context instantly are predisposed to environments where prices themselves communicate insight. In prediction markets the act of trading becomes a way to signal understanding and stake credibility in front of an audience that can see those signals evolve as events unfold.

Regulatory and institutional developments also play into this generational embrace, because the framing of these platforms under federal oversight as instruments of information aggregation gives them a legitimacy that resonates with users who have grown up skeptical of legacy gatekeepers. The combination of cultural legitimacy, technological fluency, and financial engagement creates a fertile ground for prediction markets to become a lasting fixture in how younger generations approach uncertainty, forecasting, and shared decision making.

What is unfolding is a redefinition of what it means to participate in a market when belief, data, and real-time feedback loops are native to the experience. For Gen Z, placing a prediction market contract is expressing confidence and aligning with a crowd that is simultaneously shaping and reflecting a collective sense of what tomorrow might hold. In that context, prediction markets are becoming less like alternatives to existing systems and more like extensions of how a generation already thinks about truth, possibility, and revelation in a world defined by immediate connectivity.

MARKET MOVES 📈

📈 Biggest swing: “Will Trump talk to Friedrich Merz in January” moved 41% → 98% (Polymarket)

💰 Top earner: @432614799197 - $1,091,257 24H Profit (Polymarket)

🤔 Weirdest market: “Paddy Pimblett Staph Infection by Feb. 1st?” (Polymarket)

ODDS & ENDS 📊

Polymarket has surpassed 2M unique users, with January on track for 600K unique users, 400K of them returning.

New economics research highlights how Kalshi’s predictions for fed decisions are often just as accurate as Wall Street

Elizabeth Holmes hints at truth behind Theranos fraud

RATE TODAY’S EDITION

What'd you think of today's edition? |

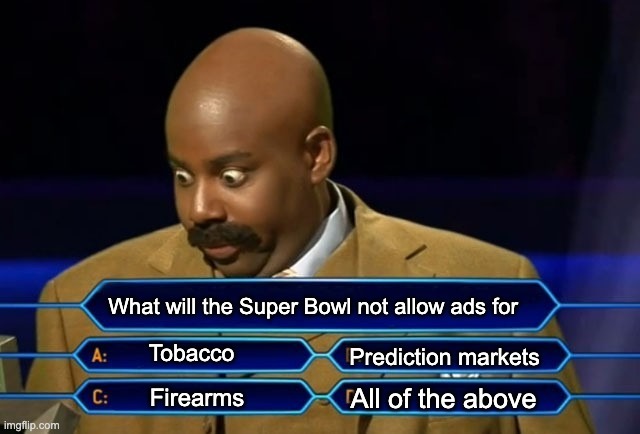

MEME OF THE DAY 😂

Crypto bros, get the spatulas ready:

Will Your Retirement Income Last?

A successful retirement can depend on having a clear plan. Fisher Investments’ The Definitive Guide to Retirement Income can help you calculate your future costs and structure your portfolio to meet your needs. Get the insights you need to help build a durable income strategy for the long term.