📊 MEET THE POLYMARKET SHARP

Plus: The briefing room has a prediction market problem, Polymarket's fee experiment works, gambling deduction blocked again

GM. You’re reading PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes.

Here’s what we got for you today:

📰 The NYT just profiled full-time prediction market traders. Wall Street is hiring them.

🛜 Barron Trump can no longer trade on White House WiFi

📈 Market Moves

📊 Odds & Ends

THE POLYMARKET SHARP GOES MAINSTREAM 📰

The New York Times just handed the prediction market industry its "mainstream moment" with a feature titled "Betting on Prediction Markets Is Their Job. They Make Millions." By profiling the "Polymarket sharp" - a disciplined trader grinding out a living on event contracts - the Times helped moved the conversation from "weird internet gambling" to a legitimate career track. It’s a massive cultural signal: editors now believe there is a "beat" here worth covering, complete with its own labor market, heroes, and wealth-creation myths. For years, crypto-natives have shouted that these markets are about information discovery; now, the NYT is finally treating them as financial venues rather than novelty casinos.

The article introduces a character archetype that will feel familiar: the sharp. Unlike the "degen" betting on vibes or the political pundit spinning narratives without consequence, the sharp is an arbitrage machine. Whether it’s Joel Holsinger making $3,000 a week on "which turkey" markets or pseudonymous whales like "Domer" treating Polymarket like slow-motion poker, the edge here isn’t thesis investing. It’s microstructure alpha - speed, contract semantics, and the ruthlessness to exploit pricing errors between Kalshi, Polymarket, and PredictIt. It’s high frequency trading on reality.

Source: New York Times

The NYT borrowing "sharp" from sports betting vernacular is telling: it implies process, discipline, sizing. These aren't punters. They're grinders who treat event contracts like a craft. Wall Street has noticed, and the institutionalization is already deeper than most realize. Susquehanna International Group (SIG), a pioneer in options market making and a part-owner of Kalshi, is actively hiring traders to watch sports and place bets. The Financial Times and Bloomberg report that other prop shops are following suit, hunting for "uncorrelated alpha". We are watching the industrialization of the prediction trade in real-time.

Of course, all of this is happening while the regulatory landscape is still a mess. A Massachusetts judge just issued a preliminary injunction limiting Kalshi's sports contracts. Nevada ruled Kalshi is subject to state gaming rules. The CFTC vs. state regulators fight is far from settled. And insider-trading concerns are now part of the mainstream narrative - Polymarket's $1 million Google payout triggered a wave of "inside info?" speculation. Compliance risk is real, especially if you're employed in finance and trading these on the side.

Ultimately, the rise of the "Polymarket sharp" validates Vitalik Buterin’s vision of "Info Finance", but with a mercenary twist. These traders aren't doing it for the civic good of forecasting; they’re doing it because they found a market inefficient enough to pay them for correcting it. The pundit era of no-stakes forecasting is dying a slow death, replaced by a brutal new meritocracy where "skin in the game" isn't just a metaphor, but a job requirement. If you can’t back your view with liquidity, you’re just noise.

So what does the NYT profile actually mean? I think it's a sign that prediction markets have crossed a threshold. When the New York Times profiles the operators - not the scandal, not the platform, not the concept - it signals that editors believe there's a real industry here. One with jobs, strategies, and wealth creation. The question now isn't whether prediction markets are legitimate. It's who's going to own the infrastructure, who's going to capture the flow, and whether the crypto-native platforms that built this market can hold their position as the suits move in.

WASHINGTON'S PREDICTION MARKET FIX: BLOCK THE WIFI 🛜

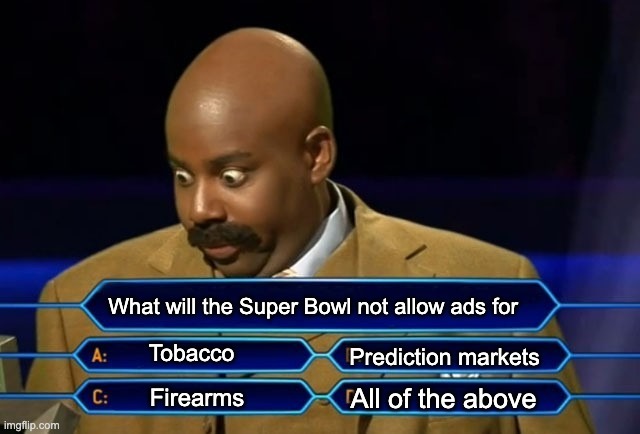

Prediction markets are now a multi-billion dollar industry. Washington's response: block them on the WiFi. Polymarket and Kalshi are both inaccessible on the White House Press network and the House of Representatives'. The Senate's network is fine. No one knows when this started or who made the call.

The blocking comes as prediction market activity around White House press briefings has become its own little economy. Users bet on when Press Secretary Karoline Leavitt will take the podium, how long she'll speak, and which words she'll use. "ICE," "narco-terrorist," and "radical left" are popular picks. Earlier this month, Leavitt ended a briefing seconds before users could cash in bets that it would last longer than 65 minutes.

A White House official pointed to federal gambling regulations when asked about platform use in the briefing room. But both platforms have spent years arguing in court that what they offer isn't gambling, Kalshi calls its contracts "swaps" and frames activity as "futures trading." Meanwhile, Rep. Ritchie Torres introduced a bill banning government officials from trading on material nonpublic information, prompted by a user who made $400,000 betting on the Maduro capture hours before it happened.

Kalshi's CEO backs the Torres bill, while Polymarket's CEO has gone the other direction, suggesting insider trading is actually good for markets. The industry just hired former Rep. Sean Patrick Maloney to lead its new lobbying group, which means WiFi blocks are probably the least of anyone's concerns. Reporters in the briefing room will have to use their phone data for now.

MARKET MOVES 📈

📈 Biggest swing: “Tesla launches unsupervised full self driving (FSD) by June 30, 2026?” moved 28% → 75% (Polymarket)

💰 Top earner: @kch123 - $583,052 24H Profit (Polymarket)

🤔 Weirdest market: “Hillary Clinton charged by March 31?” at 8% (Polymarket)

ODDS & ENDS 📊

Polymarket pulled in $800k in fees this week from 15-minute crypto markets, a quiet proof that their fee structure doesn't break liquidity.

The 100% gambling loss tax deduction got blocked again this morning after a House committee adjourned without voting on the provision. Bipartisan proponents will have to find another path forward.

RATE TODAY’S EDITION

What'd you think of today's edition? |

MEME OF THE DAY 😂

Regulators asking the Trump administration for prediction market oversight