📊 Kalshi vs Polymarket: grocery edition

Plus: Crypto.com enters the prediction market space, Kairos raises $2.5M from a16z crypto to build Kalshi trade terminal, Kalshi leads platforms in January notional volume

GM. You’re reading PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes.

Here’s what we got for you today:

🛒 Kalshi and Polymarket are fighting over your groceries

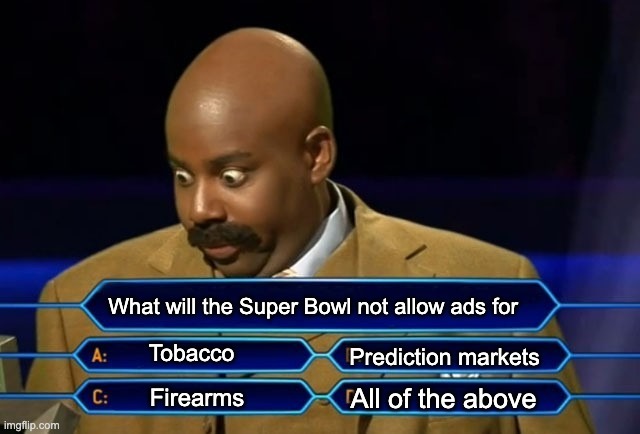

🎯 Crypto.com launches standalone prediction market app days before Super Bowl

💰 Kairos enter prediction market space with hot investment from a16z

📈 Market Moves

📊 Odds & Ends

KALSHI AND POLYMARKET GO HEAD-TO-HEAD WITH NYC GROCERY GIVEAWAYS 🛒

Kalshi and Polymarket are in a grocery giveaway arms race. Both prediction markets are running free food promotions in New York City this month, in what looks like a playful jab at Mayor Zohran Mamdani's pledge to open city-run grocery stores.

Kalshi moved first. Yesterday, shoppers at Westside Market in Manhattan's East Village could get up to $50 in free groceries, covered by Kalshi. We went down to check it out and saw the line stretched down the block.

Kalshi’s NYC grocery giveaway at Westside Market

Polymarket's response: we're opening an entire grocery store. "The Polymarket" opens February 12 and runs through the 15th (location TBA) billing itself as "New York's first free grocery store."

“Free groceries. Free markets. Built for the people who power New York," Polymarket said in its announcement. The company also donated $1 million to Food Bank for New York City, confirmed by a spokesperson. The activation took months of planning, according to Polymarket, including permits, a dedicated retail buildout, and non profit partnerships.

Source: Polymarket

This is brand marketing, full stop. Both platforms have exploded in popularity over the past 18 months and are now racing to lock in mainstream recognition. Polymarket has partnered with the Golden Globes and Dow Jones. Kalshi has deals with CNN and CNBC. Handing out free groceries in NYC is the consumer-facing version of the same playbook: get people who've never heard of prediction markets to associate your name with something good.

CRYPTO.COM ENTERS THE ARENA 🎯

Crypto.com launched OG yesterday, a standalone prediction markets app spun off from its main trading platform. The timing is perfect: Super Bowl LX kicks off February 8, and the company is betting that the biggest betting event of the year is the right moment to acquire users. First million sign-ups get up to $500 in rewards.

OG runs on Crypto.com Derivatives North America (CDNA), the CFTC-registered exchange Crypto.com acquired in 2022. Nick Lundgren, who remains Crypto.com's Chief Legal Officer, will serve as OG's CEO. The company claims 40x weekly growth in its prediction markets business over the past six months - growth significant enough to justify building a dedicated platform rather than keeping event contracts as a feature inside the main app. That decision mirrors a broader industry trend: prediction markets are maturing from novelty sidebar to core product.

The feature set is designed to poach sports bettors. OG prominently advertises that "sharps, VIPs, analytical thinkers are all encouraged and winners won't be banned" - a direct shot at DraftKings and FanDuel, which routinely limit or ban profitable users. Whether OG can maintain that policy at scale is an open question, but the marketing knows its audience. Social features like leaderboards and trader following borrow from Polymarket's playbook, adding a community layer that most traditional sportsbooks lack.

The most aggressive claim is margin trading. OG says it will become the first U.S. prediction market to offer leverage once CFTC-certified, allowing traders to access margin-based contracts through Crypto.com's federally licensed futures commission merchant. If approved, that would fundamentally change position sizing for serious traders. It's a bold roadmap item, though the "subject to CFTC certification" caveat is doing a lot of work.

On fees, OG's flat per-contract structure ($0.02 on $1 contracts, $0.20 on $10 contracts) is straightforward for casual traders but less competitive for high-volume players. Polymarket's 0.01% rate and Kalshi's probability-weighted formula offer meaningful savings at scale. For retail users buying small positions on the Super Bowl, the difference is negligible.

OG launches into a crowded field where fee compression, liquidity depth, and regulatory positioning will determine who survives. Crypto.com has deep pockets and an existing user base to bootstrap volume, but Kalshi and Polymarket have entrenched positions. The margin trading roadmap is the clearest differentiator - if it clears CFTC approval. For now, OG is another well-capitalized entrant racing to capture demand before the regulatory landscape settles. The Super Bowl will provide a clean test of whether Crypto.com's standalone bet pays off.

KAIROS REVOLUTIONIZES PREDICTION MARKETS 💰

Prediction markets have spent the last eighteen months shedding their reputation as clever research toys and stepping into the role of serious financial instruments, with traders expressing views on elections, macro releases, weather systems, sports outcomes, and cultural moments through contracts that increasingly resemble a native asset class rather than an exotic curiosity. As volumes have grown and attention has followed, the underlying market structure has strained under its own ambition, producing an ecosystem where every event fractures into outcomes, every outcome spawns listings, and every listing ricochets across exchanges with prices and liquidity that shift faster than most interfaces can coherently represent.

The practical experience of trading these markets reflects that fragmentation. Positions sprawl across venues, data arrives through disconnected and costly feeds, and execution tooling remains stubbornly primitive relative to the sophistication of the products themselves. Professional traders who would otherwise focus on information and probability find themselves burning cycles stitching together dashboards and scripts just to track exposure, a workflow that feels increasingly misaligned with instruments designed to encode the future in real time. The result is a market that rewards those willing to endure operational friction rather than those best equipped to price uncertainty.

Kairos enters this environment with a clear thesis that the bottleneck sits at the layer where intelligence and execution should converge. Framed as a unified terminal for prediction markets, the product positions itself as a single surface for real time pricing, news ingestion, analytics, and low latency execution, borrowing the mental model that Bloomberg once imposed on equities and fixed income and applying it to a category still trading through browser tabs and spreadsheets. The pitch targets traders who already understand these markets and feel constrained by tooling rather than opportunity.

The team behind Kairos leans heavily on its pedigree, having built infrastructure inside high frequency trading firms and exchanges where microseconds and reliability define success. That background informs both the emphasis on performance and the broader ambition to act as connective tissue rather than a closed destination. The terminal represents the first expression of a larger plan to become a foundational layer that links traders, exchanges, and developers through shared infrastructure, enabling new applications to emerge atop a common execution and data backbone.

This platform strategy aligns with the sense that prediction markets are approaching an inflection point, where marginal improvements in liquidity or contract design matter less than the ability to aggregate information cleanly and act on it without delay. By centralizing order books, analytics, and news in one place, Kairos aims to shift the competitive edge back toward insight and speed of conviction, echoing how institutional tools reshaped traditional markets once access and information asymmetries narrowed.

The announcement of a 2.5 million dollar round led by a16z crypto with participation from Geneva Trading, the University of Illinois, tier10k, and a broad angel syndicate signals confidence that this layer deserves venture scale investment. Capital alone will fail to guarantee adoption in a space defined by fee pressure and regulatory uncertainty, though the presence of experienced market participants among backers suggests a belief that tooling represents the missing piece rather than another incremental exchange.

Kairos ultimately frames itself as infrastructure for those who move early and trade with intent, offering the promise of an institutional desk distilled onto a laptop screen. Whether it can impose order on a market built around expressive chaos will depend on execution and adoption, though the direction of travel feels clear as prediction markets continue their transition from scattered experiments into a cohesive financial arena. See you in the order books.

MARKET MOVES 📈

📈 Biggest swing: “Will Russia enter Sofiivka by by February 28?” moved 51% → 99% (Polymarket)

💰 Top earner: @BWArmageddon - $389,121 24H Profit (Polymarket)

🤔 Weirdest market: “Where will the US & Iran meet?” (Polymarket)

ODDS & ENDS 📊

Kalshi leads prediction markets with $9.5B in notional volume in January.

Nevada sues Coinbase over alleged unlicensed sports betting offerings

Judy Shelton remains in Kalshi race despite Fed Chair nomination

RATE TODAY’S EDITION

What'd you think of today's edition? |