📊 Kalshi takes its first L

Plus: Polymarket lands major sports streaming deal, Kalshi enters the ring of fast-cycle trading, and Unusual Whales is now watching prediction markets.

GM. You’re reading PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes.

Here’s what we got for you today:

🚫 Massachusetts becomes the first state to successfully block Kalshi's sports markets via court order

🥊 Polymarket goes mainstream with DAZN

🏎️ Kalshi speeds up its crypto trading offerings

📈 Market Moves

📊 Odds & Ends

MASSACHUSETTS CALLS KALSHI’S BLUFF 🚫

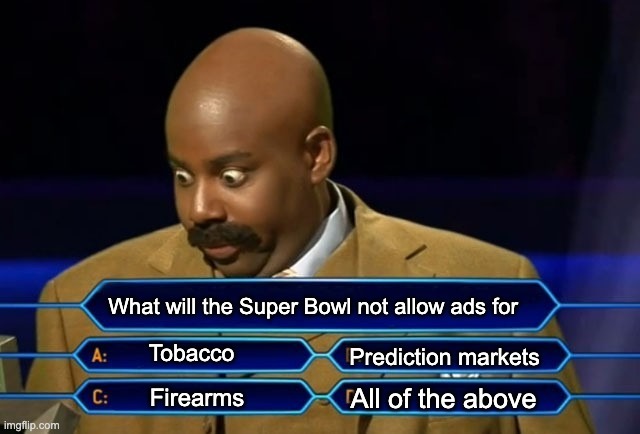

Massachusetts has handed Kalshi its first major loss in the state-versus-federal turf war. A Massachusetts state court judge ruled Tuesday that Kalshi can't offer sports event contracts to Bay State residents without a state sports wagering license. It's the first preliminary injunction entered against a prediction market platform - a notable shift after months of courts blocking states from enforcing their laws against Kalshi, not the other way around.

Suffolk County Superior Court Judge Christopher Barry-Smith rejected Kalshi's core defense: that the CFTC's authority over exchange-traded derivatives preempts state gambling laws. He called that reading "overly broad," writing that Congress never intended to displace traditional state powers to regulate gambling. The framing matters - Massachusetts argued it's regulating an addictive product marketed to 18-year-olds, while the state's licensed sportsbooks are capped at 21+. "There is no real question that licensure, and the consequent oversight, of sports wagering operations in the state serves both public health and safety, and the Commonwealth's financial interest," Barry-Smith wrote.

The injunction only blocks new contract listings; Massachusetts traders can still hold and settle existing positions. Kalshi plans to appeal, and the court will consider Friday whether to stay the order while that plays out. But the implementation mechanics signal how other states might follow: geofence new sports contracts, leave current positions alone, and force the preemption fight into appellate courts.

What likely tipped the scales was the economic reality of the product. The court noted that Kalshi’s sports contracts, which now make up the majority of its volume, mirror digital gambling experiences, complete with parlay-style mechanics and terminology that feels more like a sportsbook than a futures exchange. That distinction matters when you consider the distribution: Massachusetts noted that roughly $1 billion in Kalshi wagers were traded via Robinhood in Q2 alone, putting what the state considers an unlicensed gambling product directly into retail brokerage accounts.

For the industry, this is a significant momentum shift. Until now, the "federal preemption" shield had held up reasonably well against state regulators. But by successfully framing this as a public health and safety issue, pointing to Kalshi’s 18+ age limit versus the state’s 21+ gambling requirement, Massachusetts has provided a blueprint for other aggressive regulators to follow.

DAZN TO INTEGRATE POLYMARKET INTO US SPORTS STREAMS 🥊

DAZN is partnering with Polymarket to embed real-time prediction market data into its US live sports broadcasts. Viewers will see event probabilities on screen, think Jake Paul's odds of beating Anthony Joshua, and be able to buy and sell contracts without leaving the platform. DAZN plans to apply for CFTC licenses to launch full prediction trading in the US with other countries potentially following.

"Every sporting event is a conversation about what happens next," said Polymarket CEO Shayne Coplan. "Through our first-of-its-kind partnership with DAZN, we're embedding those insights directly into the viewing experience, from boxing to the Champions League."

The timing matters. Polymarket only regained US access in November 2025 after a three-year ban. Now it's getting placement in front of millions of DAZN viewers. DAZN already runs sports betting through DAZN Bet, so prediction markets slot in alongside the existing setup.

The deal comes as states continue to push back. Nevada's Gaming Control Board filed a civil enforcement action against Polymarket on Monday, following similar moves against Kalshi and Robinhood. Coplan has said the legal disputes will likely end up at the Supreme Court. For now, the distribution play continues.

KALSHI JOINS RIVAL IN FAST-CYCLE TRADING 🏎️

Today, Kalshi rolled out 15-minute crypto trading markets on BTC, ETH, and SOL. Polymarket, who released this product in October, has already shown that in these quick markets, crypto trades less on intrinsic value and more on who is watching closely and reacting fastest. This move feels like a quiet admission about where the real money has been flowing.

Short-horizon crypto markets have been one of Polymarket’s most effective engines for revenue growth, and the pattern is familiar to anyone who has watched liquidity recycle itself faster as settlement windows shrink. Kalshi stepping into that same rhythm suggests an understanding that prediction markets no longer win by offering better questions, but by offering tighter feedback loops.

There is also a portfolio logic at work that does not need to be spelled out too loudly. Kalshi’s recent success has been anchored in sports, which brings certain risk in a singular revenue engine. In order to keep up, they must diversify.

Fast-cycle crypto markets offer a way to rebalance Kalshi’s identity without abandoning the event contract frame, while tapping into a user base already comfortable with probabilistic thinking in short intervals. Polymarket has been already monetizing immediacy, and Kalshi is now signaling that it is willing to meet that standard rather than defend a slower conception of what an event is supposed to be.

From the stands of the arena, it’s incredibly interesting to watch market titans compete. It feels like every day, Kalshi or Polymarket is releasing a new product feature that their counterpart recently released. Time will only tell who wins the war, or if there will be a winner at all.

MARKET MOVES 📈

📈 Biggest swing: “Will the Supreme Court rule on Trump’s tariffs by January 31” moved 70% → 11% (Polymarket)

💰 Top earner: @0x492442eab586f242b53bda933fd5de859c8a3782 - $1,302,115 24H Profit (Polymarket)

🤔 Weirdest market: “Justin & Hailey Bieber split in 2026?” at 24% (Polymarket)

ODDS & ENDS 📊

Prism launches support for Polymarket trading on MegaETH.

Unusual Whales adds prediction market tracking to spot unusual activity and insider moves.

Steak N’ Shake now offering Bitcoin bonuses to staff

RATE TODAY’S EDITION

What'd you think of today's edition? |

MEME OF THE DAY 😂

Will Your Retirement Income Last?

A successful retirement can depend on having a clear plan. Fisher Investments’ The Definitive Guide to Retirement Income can help you calculate your future costs and structure your portfolio to meet your needs. Get the insights you need to help build a durable income strategy for the long term.