📊 An AI just beat 99% of human traders

Plus: Schwab leader looks into prediction markets, Susquehanna seeks new types of traders, and Martin Shkreli brings his hot takes on the new space.

GM. You’re reading PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes.

Here’s what we got for you today:

🤖 Mantic's AI places top 1% in Metaculus tournament

🏦 Schwab CEO says he's open to prediction markets but not sports betting

💰 SIG takes bet on prediction markets

📈 Market Moves

📊 Odds & Ends

THIS AI OUTPREDICTS 99% OF HUMANS 🤖

Mantic, a London-based AI forecasting startup, just placed fourth out of ~500 entrants in the 2025 Metaculus Fall Cup, a quarterly forecasting tournament where participants compete to make the most accurate predictions across dozens of questions. That puts them in the top 1% of human forecasters and makes them the best-performing AI system we're aware of.

Their edge isn't better prompts. It's data infrastructure. They've built their own corpus of dozens of sources that can be rolled back for backtesting.

CEO Toby Shevlane says calibration matters as much as conviction. In the Dutch election, Mantic scored points not by calling the winner but by being less overconfident than the crowd. Same with Japan's leadership race: markets had heavy weight on one candidate, Takaichi won, and Mantic had been giving her more probability all along.

The company works with traders on traditional financial markets rather than trading Polymarket directly. The use case is predicting events upstream of price changes, like how different Japanese leaders might affect bond yields.

Where does Mantic disagree with Polymarket now? They have Jerome Powell being federally charged by June at 26% vs. Polymarket's 12%. They're lower on Greenland acquisition: 8% vs. 25%. And they see US strikes on Iran at 52% by end of March.

SCHWAB SAYS YES (BUT NOT REALLY) 🏦

Schwab CEO Rick Wurster told Bloomberg he's "absolutely open" to adding prediction markets to the platform but only the kind that belong in a portfolio. Think contracts on the jobs report or CPI print, not whether the Chiefs cover. "I distinguish between prediction markets and gambling," he said, estimating that 95% of current prediction market volume is "actually just sports gambling." Wurster was clear: leave that to "the gambling houses… the DraftKings and the Robinhoods."

Source: Bloomberg

Chuck Schwab, the founder, did invest in Kalshi's $30 million Series A, which could be a hedge, a future acquisition target, or just a personal bet that prediction markets eventually go mainstream.

The real tell is what Schwab is actually prioritizing: 24/5 trading, private markets access through the Forge acquisition, and expanded tax and estate tools. Wurster admitted prediction markets are "low on the list" of client requests.

The backdrop makes Wurster's restraint look smart. If the regulatory environment is about to get tighter, the last thing a $12 trillion custodian needs is to be caught on the wrong side of a gambling litigation. Schwab's move here is less about principle and more about risk management, and for now, that means watching from the sidelines while Robinhood takes the heat.

SUSQUEHANNA IS HIRING PM TRADERS 💰

It’s the cleanest arb in finance: work for a billionaire-backed trading firm, watch sports all day, and get paid to trade prediction markets instead of sweating your own bankroll. Wall Street finally legitimizes the group chat argument.

A sports trader at Susquehanna International Group starts around $90,000 a year, according to people familiar with the matter. It’s above the U.S. median household income, but dramatically below what most people associate with hedge funds, trading floors, or anything involving a billionaire owner.

The salary gap reflects where prediction markets actually are, not where the hype says they are. Firms like Susquehanna are still experimenting, figuring out whether platforms like Kalshi and Polymarket are durable profit centers or just another trade that looks good in a deck. When the business model is uncertain, compensation follows.

However, Susquehanna is also recruiting more specialized prediction-market traders with quantitative finance backgrounds, roles that could pay closer to $350,000. But even there, some of the gamblers being courted aren’t convinced. If you can consistently price sports better than the market, you can probably make more betting your own money than clocking in for a firm that caps your risk and monitors your process.

SIG does have some experience in the prediction markets space already. Founded by Jeff Yass, they were an early entrant into prediction markets and are a part owner of Kalshi. It already employs roughly 60 traders focused on buying and selling contracts to keep markets liquid and trading on their own views. Recent job postings show the firm doubling down—sports traders covering the NFL and NBA live, and broader prediction-market specialists—though compensation is conspicuously absent from the listings.

The broader context matters: prediction odds are suddenly mainstream, splashed across CNBC and award shows after court rulings opened the door for U.S. operations. Anyone with an account can bet on the Super Bowl or A$AP Rocky’s album sales. Trading firms see the flow and want a cut. Jump Trading and other high-frequency shops are hiring too, with much of the interest coming from outside the U.S.

The pattern is familiar, and every new market starts by promising freedom, upside, and edge before institutionalizing. What begins as gambling ends up looking like market making, with salaries that reflect stability, not glory. The dream job exists, but it turns out that watching sports for a living pays a lot more when you’re betting yourself.

MARKET MOVES 📈

📈 Biggest swing: “Will Zelenskyy attend the World Economic Forum?” moved 10% → 81% (Polymarket)

💰 Top earner: @gmanas - $616,427 24H Profit (Polymarket)

🤔 Weirdest market: “Will MoistCr1TiKaL get a haircut in 2026?” at 48% (Polymarket)

ODDS & ENDS 📊

Interactive Brokers CEO says weather and temperature contracts are their most traded prediction markets and utilities will soon hedge electricity and gas using event contracts.

Martin Shkreli explains why he's both bearish on prediction markets and runs a Polymarket market-making bot

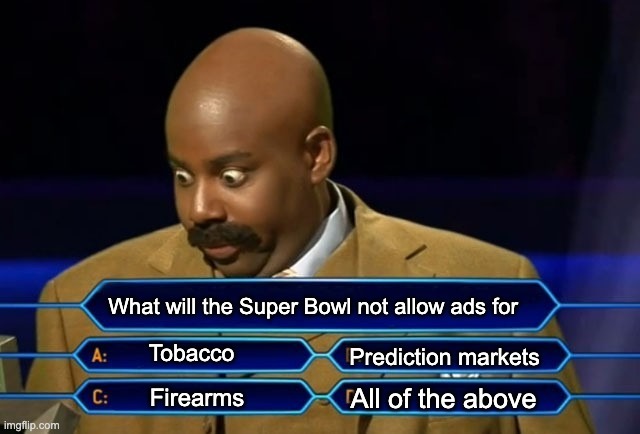

Polymarket US still has a long ways to go, for now just sports

RATE TODAY’S EDITION

What'd you think of today's edition? |

MEME OF THE DAY 😂