📊 Kalshi takes big swing on first major athlete signing

Plus: Polymarket's Venezuela insider trader busted, gambling sector outpaces most of the economy, Noise raises $7.1M

GM. You’re reading PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes.

Here’s what we got for you today:

⛳️ Kalshi signs systems-oriented big swinger

🔒 Venezuela leaker arrested; linked Polymarket account goes dark

🇺🇸 Gambling becomes second fastest growing sector of the economy

📈 Market Moves

📊 Odds & Ends

KALSHI SIGNS BRYSON DECHAMBEAU IN FIRST PREDICTION MARKETS ATHLETE DEAL ⛳️

Bryson DeChambeau signing with Kalshi represents a natural alignment between an athlete who treats golf like a system and a market built to price uncertainty.

Credit: © Brendan Mcdermid-Reuters via Imagn Images/ Kalshi

Of course it’s Bryson. The guy who treated golf like an optimization problem was always going to end up adjacent to markets that price reality itself. In signing with Kalshi, he is affirming a new worldview, something only he would be the first to do.

Prediction markets have spent the last few years drifting from “weird internet corner” to “thing smart people quietly check before forming opinions.” Kalshi wants to make that drift visible. Bryson is how you do it without pretending you’re still underground.

He’s an unusual athlete in the exact right way. Publicly obsessed with data. Comfortable narrating his own process. Willing to look a little strange if the numbers justify it. Golf fans used to hate that about him, and finance people recognize it immediately.

What’s interesting isn’t that people can trade on Bryson outcomes, that part is obvious. It’s that the relationship flips the usual sponsorship dynamic. Bryson is selling uncertainty. His brand works precisely because everyone knows he can either dominate or combust, and both outcomes feel plausibly priced. That’s a better fit for Kalshi than a squeaky-clean superstar ever would be.

There’s also something very 2020s about a LIV golfer, already semi-detached from traditional sports institutions, becoming the face of markets that exist in a regulatory gray zone. Parallel systems recognizing each other.

Golf has always pretended to be about tradition while quietly rewarding whoever found the next edge first. Bryson just made the edge explicit.

This deal is a statement, one that puts prediction markets in the likes of major fortune 500 companies like Nike, Apple, Vista, and more. It’s a tangible shift in the landscape.

If Kalshi was going to pick one athlete to represent that shift, it was never going to be anyone else.

FROM POLYMARKET PAYDAY TO PRISON 🔒

Today, President Trump announced that the Venezuela insider trader has been identified and is now in jail.

If you're a regular reader, you might remember last week's story: an anonymous Polymarket account, created in late December, bet around $30K on Maduro being removed from power, then cashed out $436K after U.S. forces captured him. The bets spiked hours before Trump announced the raid.

While officials haven't confirmed the arrested individual is the trader, the Polymarket profile linked to the winning wallet has gone dark, and blockchain data shows that the account immediately moved the funds after cashing out.

This creates a messy situation for the prediction market industry, which is already under the microscope. Rep. Ritchie Torres just introduced the "Public Integrity in Financial Prediction Markets Act of 2026" to ban federal officials from trading on nonpublic info, and this case is exactly the kind of ammunition critics were looking for. Whether or not the leaker and the trader are the same person, the optics alone are enough to force a regulatory crackdown.

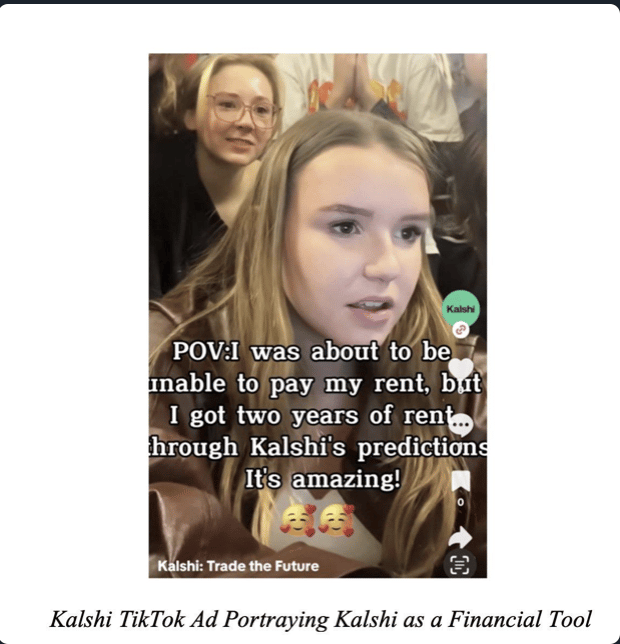

GEN Z AND MILLENIALS BET FINANCIAL FREEDOM ON GAMBLING 🇺🇸

The fastest-growing sector in the U.S. economy isn't AI or healthcare. It's gambling.

According to the Bureau of Labor Statistics, gambling output grew 7.6% annually in terms of GDP growth, second only to software publishers at 8.9%. This change represents a structural shift in where American money is going.

The math is bleak for younger workers. There's a housing shortage of 15 to 20 million units according to the Erdmann Housing Tracker. Prices keep climbing. 22% of Millennials have given up on buying a home entirely, per Bankrate.

Economic commentator Kyla Scanlon put it bluntly: young Americans have decided that if the game is rigged, "you might as well just gamble it away." The traditional economic ladder is out of reach, so why not take a shot?

What’s interesting, however, is that despite betting gaining in popularity, young men are increasingly negative about it.

A Pew Research poll found that 47% of men under 30 now view sports betting as bad for society. In 2022, that number was just 22%. That's a substantial shift in two years, but it raises an uncomfortable question for prediction markets.

There's a fine line between gambling and using these platforms as actual financial instruments. Prediction markets can be tools for hedging risk, seeking truth, and price discovery, or they can just be gambling with better branding.

The data suggests most users may lean on the gambling side, depending on you view it. Kalshi's volume is roughly 91% sports, essentially a sportsbook with a derivatives wrapper. Polymarket looks different: 40% sports, 28% crypto, 22% politics. But even there, how much is speculation versus genuine hedging?

When a 25-year-old bets on the Super Bowl, that's entertainment, or desperation. When they bet on Fed rate decisions, is that informed speculation or a lottery ticket on their own economic future?

The line blurs fast, which is the problem regulators, platforms, and users are all trying to figure out.

The boomers of America are doing fine. Their homes appreciated. Their jobs are stable. For them, the economy still works.

For Gen Z and millennials, there's a prediction market app on their phone and an open question about whether they're investing or just gambling.

MARKET MOVES 📈

📈 Biggest swing: “GPT ads by March 31?” moved 16% → 39% (Polymarket)

💰 Top earner: @0x006cc834cc092684f1b56626e23bedb3835c16ea - $1,163,276 24H Profit (Polymarket)

🤔 Weirdest market: “Jerome Powell federally charged by June 30?” (Polymarket)

ODDS & ENDS 📊

Noise.xyz raises $7.1M from Paradigm to create a new prediction market platform focused on discovering and trading trends.

Wall St firms start buildout of prediction market arms.

Believe’s sentiment markets launch flops as volume falls to only $500/hour.

RATE TODAY’S EDITION

What'd you think of today's edition? |

MEME OF THE DAY 😂

A real Kalshi ad lol

The Headlines Traders Need Before the Bell

Tired of missing the trades that actually move?

In under five minutes, Elite Trade Club delivers the top stories, market-moving headlines, and stocks to watch — before the open.

Join 200K+ traders who start with a plan, not a scroll.