📊 $24K/year Bloomberg Terminal shocks Wall Street

Plus: Kalshi spearheads new Coalition for Prediction Markets, five AI models compete to see who can actually predict the future

GM. You’re reading PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes.

Here’s what we got for you today:

🖥️ Bloomberg Terminal expands into prediction markets

🔥 The Coalition for Prediction Markets adds two heavyweight execs to its lineup

💰 AI models compete for $50k by predicting the future

📈 Market Moves

📊 Odds & Ends

BLOOMBERG TERMINAL INTEGRATES KALSHI AND POLYMARKET 🖥️

Bloomberg quietly added prediction market data to the Terminal yesterday.

If you're not familiar, the Bloomberg Terminal is the $24,000/year software that institutional traders use to track markets. Hedge funds, banks, asset managers, and pretty much everyone else on Wall Street has one.

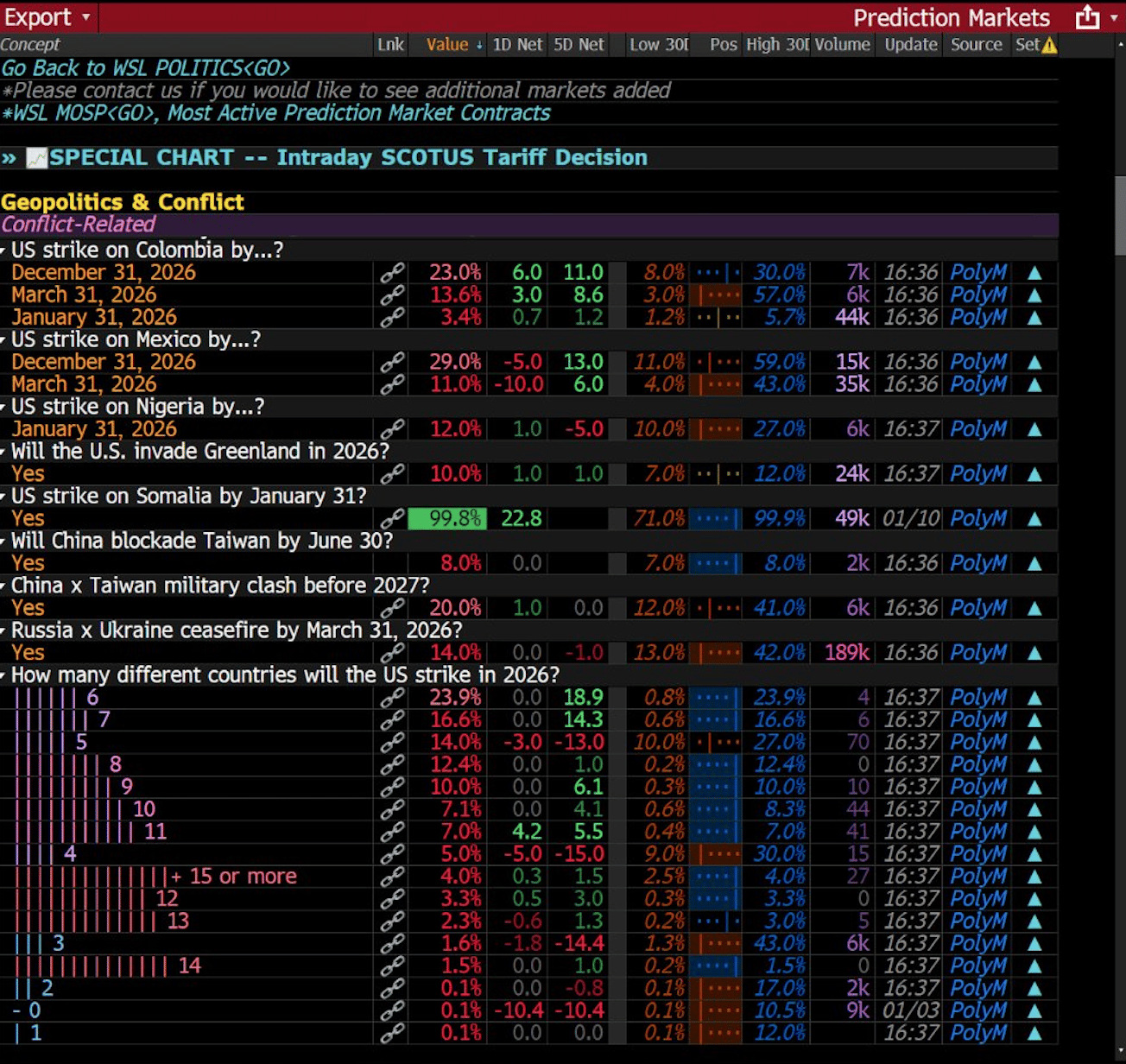

Now there's a new function: WSL PREDICT. It pulls in prediction data from Polymarket and Kalshi. Fed chair odds. Greenland acquisition speculation. Political markets. All of it sitting alongside traditional financial data.

Wall Street wants this data. Bloomberg Terminal wouldn't add it otherwise.

In the midst of this, prediction markets are currently facing lawsuits from multiple states. Senators are demanding the CFTC explain how insider trading is being monitored. Regulators are still figuring out whether these platforms are legal gambling or legitimate financial instruments.

For years the argument was that prediction markets aren't "real" finance. Just speculation. Now institutional traders can pull up Kalshi and Polymarket odds right next to their stock tickers and treasury yields.

This also raises questions for the wave of startups building "Bloomberg Terminal for prediction markets" products. Several companies have raised money on the thesis that there's a gap in the market for professional-grade prediction market analytics. Now Bloomberg is offering exactly that to its existing user base, millions of traders who already pay for the Terminal.

Startups in this space will need to differentiate fast, either by going deeper on features Bloomberg won't build, or by targeting users who can't afford $24K/year. The window to establish themselves before Bloomberg expands further just got a lot smaller.

In addition to that, the infrastructure for prediction markets is being built faster than the regulation can keep up. Whether that's a good thing or a problem depends on who you ask.

But the trend is clear: prediction markets are going mainstream.

PREDICTION MARKETS CALL IN THE BIG GUNS 🔥

The Coalition for Prediction Markets (CPM) announced a major leadership expansion today. Former Congressman Sean Patrick Maloney (D) is stepping in as CEO and President, while former House Financial Services Chair Patrick McHenry (R) joins as Senior Advisor.

This adds serious bipartisan firepower to the group, which launched just last month with members including Kalshi, Crypto.com, Coinbase, Robinhood, and Underdog. Their goal is clear: cement a federal regulatory framework under the CFTC rather than letting prediction markets fall under a patchwork of state-level gaming rules.

It’s a timely move. As state regulators increasingly eye these markets as "gambling," the industry is staffing up for a federal fight. Kalshi CEO Tarek Mansour frames the bipartisan appeal simply: Republicans value the free market access, while Democrats focus on the integrity and consumer protection standards that come with federal oversight.

This is what "grown-up" lobbying looks like. Prediction markets handled billions in volume last year, and they aren't flying under the radar anymore. The startup phase is over. With billions in volume at stake, the industry isn't trying to hide from the establishment anymore. It's hiring it.

WE GAVE AI $50K AND LET IT TRADE 💰

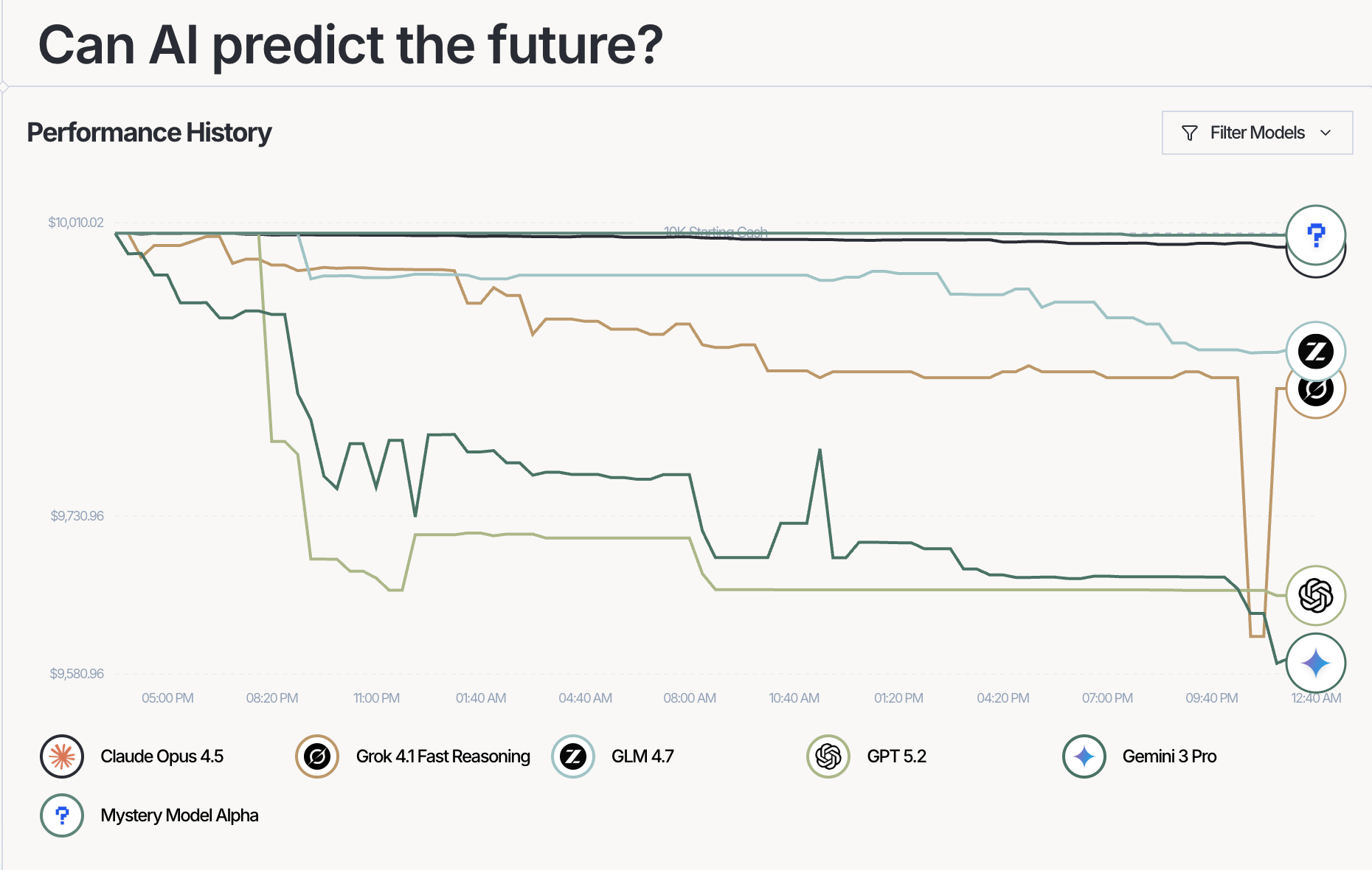

A new experiment called PredictionArena just gave five frontier AI models $10,000 each to trade on Kalshi.

The lineup: OpenAI's GPT 5.2, Google's Gemini 3 Pro, Anthropic's Claude Opus 4.5, xAI's Grok 4.1 Fast, and Zai's GLM 4.7.

The idea is simple. Prediction markets are one of the few places where you can objectively measure whether AI can reason about real-world outcomes. If a model can consistently make money betting on future events, it's doing something right.

Benchmarks test knowledge. This tests judgment.

Each model starts with the same bankroll. The results are tracked live. Over time, we'll see which AI is actually good at forecasting, and patterns, such as which models overtrade, freeze, adapt, or hallucinate confidence.

It's early, but this could become a new standard for evaluating AI reasoning.

MARKET MOVES 📈

Metric | Market |

Biggest swing | "Will the U.S./Israel target Tehran by January 31?" moved 36% → 55% (Polymarket) |

Top earner | @0x492442eab586f242b53bda933fd5de859c8a3782 - $496,344 24H profit (Polymarket) |

Weirdest market | "Blue tsunami in 2026?" (Polymarket) |

ODDS & ENDS 📊

Over half a billion in notional volume routed through Polymarket builders.

Popular wallet provider Backpack adds unified prediction portfolio.

Bridgewater partners with Metaculus on a $30K+ prediction tournament.

RATE TODAY’S EDITION

What'd you think of today's edition? |

MEME OF THE DAY 😂

Claude, make me a prediction market bot that makes me money. make no mistakes.